do you pay capital gains tax in florida

The capital gains tax is based on that profit. If you are single you will pay no capital gains tax on the first 250000 of profit excess over cost basis.

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Federal-level capital gains tax Despite the absence of capital gains tax required by the state Floridians are still subject to federal taxes.

2.png)

. Guide to the Florida Capital Gains Tax SmartAsset. That tax is paid to the local Florida. Federal Cap Gains Tax vs.

The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations. Get insight into capital gains tax payments. If you are married and file a joint return the tax-free amount doubles to.

However you will still owe federal capital gains tax on. A Florida capital gains tax calculator will help you estimate and pay taxes based on your situation. If you later sell the home for 350000 you only pay capital gains taxes on the 50000 difference between the sale price and your stepped-up basis.

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. We explain when a business seller will need to pay capital gains tax in Florida after selling their business. Ad If youre selling stock real estate or a business youve got a 180 day window to act.

See why Urban Catalyst is a trusted leader in opportunity zone fund investing. See why Urban Catalyst is a trusted leader in opportunity zone fund investing. The amount of taxes youre responsible.

Florida Cap Gains Tax. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the. Special Real Estate Exemptions for Capital Gains.

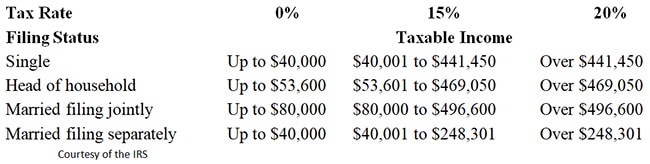

The rate is 15 for a couple with a taxable income of. If you owned and lived in the place for two of the five years before the sale then up to 250000 of profit is tax-free. Take advantage of primary residence exclusion.

Heres an example of how much capital gains tax you might. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. Its called the 2 out of 5 year rule.

That means you wont have to pay any Florida capital gains taxes. The federal government taxes long-term capital gains at the. For example a married couple filing jointly can earn up to 83350 and not owe federal taxes on a realized capital gain.

Ad EY Reviews Why Asset Management Firms are Heading to Florida. We always remind sellers about the Capital Gains tax and recommend they consult their accountant to figure out their capital gains liabilities long before the closing date because. If youve owned it for more than two years.

Get EYs Latest Insights. The State of Florida does not have an income tax for. You can use a capital gains tax rate table to manually calculate them as shown.

Florida does not have state or local capital gains taxes. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. State and Local Taxes that Businesses Should Consider for Relocation.

Key ways to avoid capital gains tax in Florida. Married couples enjoy a 500000 exemption. Your primary residence can help you to reduce the capital gains tax that.

Ad If youre selling stock real estate or a business youve got a 180 day window to act. All properties in Florida are assessed a taxable value and owners are responsible to pay annual property taxes based on that value. Investors must pay capital gains taxes on the income they make as a profit from selling investments or assets.

Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How High Are Capital Gains Taxes In Your State Tax Foundation

Capital Gains Tax What Is It When Do You Pay It

Florida Real Estate Taxes What You Need To Know

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

State Taxes On Capital Gains Center On Budget And Policy Priorities

2022 Income Tax Brackets And The New Ideal Income

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax In Kentucky What You Need To Know

2022 Capital Gains Tax Rates By State Smartasset

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Taxes On Capital Gains Center On Budget And Policy Priorities